Invest With Us

What about us and the things we do?

Invest with Prime Equities and unlock high-yield opportunities tailored to your goals. We specialize in identifying, acquiring, and optimizing investment-grade properties designed to maximize returns. Our comprehensive approach includes in-depth financial analysis, fully vetted properties, and tenant-ready solutions, ensuring a seamless investment experience. Whether you’re a seasoned investor or just starting, we provide the tools, insights, and expertise needed to build a profitable portfolio with minimal hassle. Join a network of successful investors who trust Prime Equities to deliver consistent, reliable results. Don’t just invest—invest smarter, with confidence, and with us. Your next opportunity is waiting.

Get Started Investing With Prime Equities

This is how it works once you join the investor list

Step 1: Sign Up for an Endless Flow of Deals

Look over the pre-underwritten homes we send. The deals will be sent with photos, financials (projected and current), and comparables. Just let us know when there's one that fits your investing goals!

Step 3: Commit to the Perfect Deal

Communicate with us your exact criteria, look over our top deals, when one fits exactly what you are looking for, commit with confidence.

Step 2: Become an "A-Tier" Investor

Any investor who signs up as an "all-cash" buyer will be invited to our A-Tier Deal List upon receipt of proof of funds. You will receive weekly consultations with a dedicated investment coordinator and be first in line for the best deals!

Step 4: Closing and Success

Our properties are inspected prior to contracting to simplify the closing process. However, you are welcome to conduct your own. so In escrow, our transaction coordination team will assist you in setting up title, insurance policy, property management, and tenant processing to simplify your closing experience.

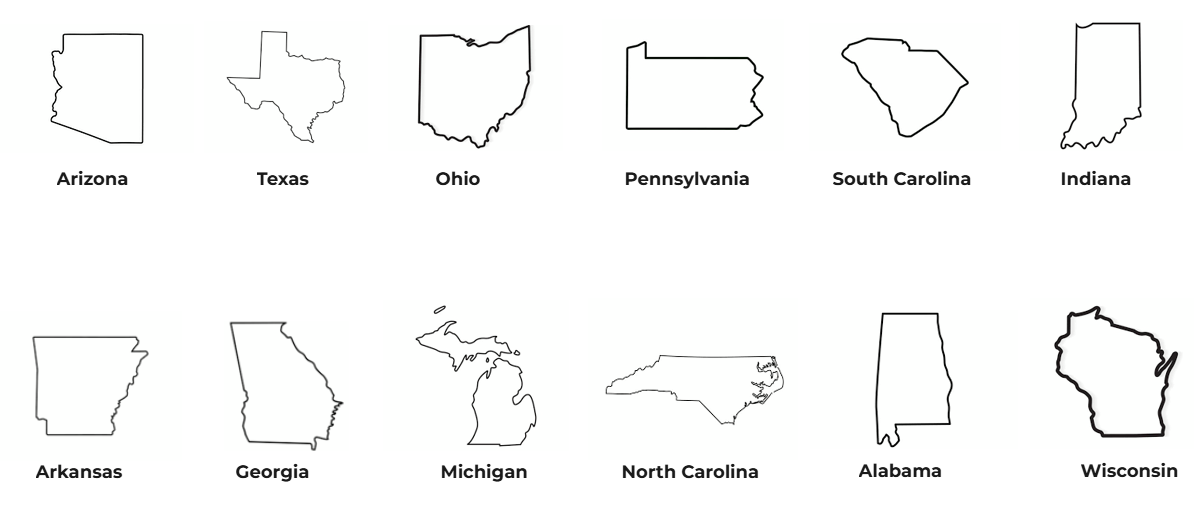

Our Core Markets

We are not limited by state. However, we have transacted 100s of deals in the states listed below and in every case, these markets generate the highest overall return. Ask us about opportunities in these areas!

Questions About Buying with Prime Equities

How can I get the best deals sooner?

- Consistently and concisely communicate your purchasing criteria and give us feedback on new deals that you do receive so we can best curate to your needs.

- Sign up for the A-Tier list by letting us know that you're ready to pull the trigger & provide us with a proof of funds to verify.

- Performing as a cash buyer whether that is your own funds or hard/private money. Majority of our deals are sold to cash buyers.

- Understand that no property is perfect, and no investment is without risk. Do your homework and be ready to dive in!

Why should we trust Prime Equities with such a big purchase?

- Honestly, you don't have to. Our mantra is that we find deals so you don't have to. We add value to deals to facilitate needs of investors that don't know how or don't have time. Most deals are turnkey. But if you're searching for something that requires more elbow grease, we can provide those opportunities too.

- You aren't forced to use our suggested property managers or contactors. We support your abilities to explore all of your options in the market.

- All rents, financials and tenant details can be verified by hard documentation.

- The comparable sales and rentals provided are directly from public records. These items can also be verified by other local professionals, you are welcome to verify with more sources than just us!

- We do not collect referral fees when you use our resources and our guidance after the acquisition is provided as a simple courtesy at no cost.

Will Prime Equities help me with contractors and property managers?

- Every offering is accompanied with referrals for 3rd-party property managers, local shops and big box operators.

- These management companies are full service, meaning they coordinate and fulfill maintenance, repairs, and upgrades from leaky pipes to paint & floors to new roofs.

- If a contractor is needed for any phase of renovation all the way from painters to electrical/plumbing/mechanical we have referrals available in our core markets.

- Prime Equities does not receive any fees for referring contractors or property managers. These relationships are offered to sustain successful operations in the acquisition through continued ownership.

- We do this as a courtesy, and are not obligated or bound by any service agreement to offer asset management services.

How does Prime Equities make money?

- Our process is easy and straightforward; we buy properties at a discount and resell it based on value added and income potential. We own some properties for longer, while we sell others quickly after acquisition.

- We don't charge commissions or fees to our investors at closing. All you pay is the sale price and standard closing costs.

What kind of due diligence documents can I expect with each deal?

- In depth pro-forma analysis supported by current income and expenses and projected fully-stabilized financials.

- Complete in-house inspection report conducted by third party source, a summary of property condition, and detailed notes on items in the inspection.

- Full tenant breakdown. Payment history, lease terms, leases, rent roll, and special case notes.

- Comparable active listings, recently closed transactions, rental listings, in depth market demographics and analysis.

If the deals are so good, why doesn't Prime Equities just buy them all?

- If money grew on trees, believe me, we would. The deal disposition side of our business was created so higher annual revenues could be generated to pay for our own internal acquisitions.

- Prime Equities overall sales and project volume dictates how and what we can acquire in a given year.

- In many cases, the decision to hold a property is tax driven. Short term capital gains is incurred when selling our properties and we acquire many deals to hedge against those gains. In other words, we don't just "keep the best properties" as it is of limited benefit for us to generate high rental revenues.

Questions About General Investing

Single Family Home or Multifamily?

- Single families homes are great because there is less tenant turnover. SFHs attract families, this leads to longer average lifetime leases and more consistent rent collection.

- Single houses are much more difficult to scale. Unit absorption is much slower as you typically buy one home per purchase as opposed to multiple doors per purchase. Cashflow also tends to be lower for SFHs as the price per unit is generally higher and rents low in relation to price when compared to mutlifamily.

- Small MF offers more rentable doors per deal and higher returns since sale pricing is relative to a single family home and more rentable units means more streams of income from a given property.

- For multifamily, as you increase in unit count so does your tenant turnover. Multifamily attracts more impermanent residents than SFH. In conjunction with turnover, maintenance expenditures also increase rapidly because you are now managing multiple families as opposed to one.

- The duplex, triplex and quadruplex are the sweet spots between SFHs and MF attracting higher quality tenants with limited management and maintenance expense growth.

How many properties do I need to be financially free?

- More than you may believe. Real estate requires constant funding to operate. Operational and maintenance expenditures are a harsh reality that makes property ownership a grind. It is recommended to spend the initial cashflow on property improvements until the property is sufficiently stable.

- Once your property is sufficiently stable, then use the cashflow to build your capex and operational reserves for unknowns. Once at a satisfactory level then you can start truly realizing the profits.

- Real estate is a game of volume, if you don't need the cashflow in the short term, save it and apply to more investments. We always suggest the use of surplus goes towards additional investments to grow income and wealth.

Do affordable homes actually appreciate?

- Appreciation and financial projections are never guaranteed as they are based on speculation. However, there are several affordable Midwest and South markets that topped the United States in YOY appreciation in 2024.

- Many of the cities we invest in are nonvolatile in nature and have experienced significant recent rent growth. These opportunities are acquired in those markets if there is reasonable cause for growth to continue in the near future.

Is owning real estate ever truly passive?

- Nope, and it never will be. With great systems and processes and consistent building of an excellent team, you will be able to push the levels of passivity up as you progress.

- When your systems and operations are in line and you properties are fully stabilized, real estate ownership will begin to feel more passive.

- A well-managed real estate portfolio can yield substantial returns on investment, it will just take lots of effort and skill.

Can owning real estate lower my taxes?

- We're not accountants. Ask a qualified CPA for accounting advice. The following are a couple insights that we can share from our own experiences.

- Depreciation in real estate can result in deductions on a tax bill.

- Unrealized gain can allow for equity that has not been liquidated to be non-taxable.

- In many cases, funds deposited from a cash-out refinance is not a taxable event.

- Seriously, consult a CPA.

What type of entity should I buy real estate in? How do I create them?

- We're not lawyers. Consult one if you need legal advice. Here's some insights we can share that we've seen throughout the industry.

- LLCs or Land Trusts tend to be the most common entities created in the ownership of real property.

- As many investors grow, so does their corporate structure. These structures go from one LLC holding many properties to include multiple LLC's for properties.

- Investors can also minimize liability by having sufficient insurance policies such as property liability, umbrella liability, and business liability policies.

- You can form an LLC online, directly through a state website. This is an inexpensive alternative that carries the risk of uninformed incompetence. Consult an attorney if you need help, the health of you empire depends on it.